Which of the Following Produces Evaluations of Insurer Financial Status

Identify payment solutions or financial assistance options that may assist them with their obligations for this visit. Most commonly known and widely used type of transactional insurance.

A Universal Life Insurance policy is best described as a.

. The insurer must be able to rely on the statements in the application and the insured must be able to rely on the insurer to pay valid claims. 2 Adult refers to those ages 18 and older. The insurer credits the cash value in the policy with a guaranteed interest rate.

Which of the following produces evaluations of insurers financial status often used by state departments of insurance. Federal Deposit Insurance Corporation FDIC D. 2 All of the following a and b.

1 quality of care and health outcomes 2 access to care 3 health care costs and cost-effectiveness 4 patient perceptions and 5 clinician perceptions IOM 1996. Monitor financial market trends to ensure that client plans are responsive. Combined with a review of research and consultation with leading experts the CFPB found that financial well-being includes the following elements.

Multi-line Insurers 40301030 Companies with diversified interests in life health property and casualty insurance. SUPPLIER EVALUATION QUESTIONNAIRE GP040 F1 Rev 10 Page 1 of 17. The selling of product or services to a customer through distinct channels of delivering for earning the profit then this process is known as the retailers.

For additional information about continuing education call us at 1-800-926-7926. The report presented a framework built upon five main evaluation elements. An insurer that holds a certificate of Authority in the state in which it transacts business is considered aan.

Section II Loss Assessment Coverage applies to assessments against the insured by a condominium association or other cooperative body of property owners. State Administrative and Accounting Manual. The satisfaction of demand is being recognized through a supply chain by the retailers.

All other factors being equal the least expensive first-year premium payment is found in. Benefits are paid to the borrowers beneficiary. A SEC b AM Best c NAIC d Consumers guide AM Best Company assigns ratings to life property and casualty insurance companies based upon the financial stability of the insurer.

In forming of an insurance contract this is referred to as. The insurer backs the cash value with a current interest rate. The insurer backs the cash value with a.

Adopts and periodically updates the. AIG Hartford Financial Services Group Inc. Once screening has occurred and the patient is stabilized the provider organization will review insurance eligibility information with the patient to ensure information accuracy.

Federal Insurance Corporation FDIC What company produces evaluations of insurer financial status often used by the insurance department. B AM Best AM Best Company assigns ratings to life property and casualty insurance companies based upon the financial stability of the insurer. Research during the past decade shows that social class or socioeconomic status SES is related to satisfaction and stability in romantic unions the quality of parent-child relationships and a range of developmental outcomes for adults and children.

C NAIC 4. All of the following statements are correct regarding Credit Life Insurance EXCEPT. Part A seeks background information.

Guide clients in the gathering of information such as bank account records income tax returns life and disability insurance records pension plans or wills. Since 1996 the field of telemedicine has continued to evolve and mature. Examples include American International Group Inc.

The questionnaire is split into 9 distinct parts. The agent is guilty of Rebating The mode of premium payment Is defined as the frequency and the amount of the premium payment. That prescribes and requires the maintenance of uniform systems of accounting and reporting for agencies.

Covers financial losses resulting from any defects or deficiencies in. Which of the following produces evaluations of insurers financial status often used by state departments of insurance. C Medical exam 3.

A The agent puts up a sign with the insurers logo without express permission BThe agent accepts a premium payment after the end of the grace period CThe agent accepts a premium payment during the grace period DThe agent has business cards and stationery printed The insured will need a written consent of the insurer. Ongoing financial obligations can feel secure in their financial future and is able to make choices that allow them to enjoy life. Part B requests details of your financial status.

Coverage is limited to 1000 but an increased limit of coverage is available by endorsement. 1 Graduation from an accredited four-year college or university with a degree in insurance accounting or finance and experience equal to seven years of full-time work in insurance company examination or financial auditing or insurance company financial analysis. An insured pays a 100 premium every month for his insurance coverage yet the insurer promises to.

That you will receive immediately following the program. Does the target rely on additional insured status under its. A SEC B AM Best C NAIC D Consumers guide Answer.

This review focuses on evidence regarding potential mechanisms proposed to account for these. Pension Civil Judgment Awards Pending. Wingler Communications Corporation WCC produces premium stereo headphones that sell for 2880 per set and this years sales are expected to be 450000 units.

Financial Status Net Monthly Income Houses Land Market Value Spousal Cohabitant Contribution Value of All Motor Vehicles Unemployment Disability Cash Social Security Current Balance Checking Accts. It is the process of distribution in which selling of goods directly to the consumers. Which of the following produces evaluations of insurers financial status often used by state departments ofinsurance.

Old agesurvivors and disability insurance social security B. Veterans Administration Current Balance Savings Accts. HIG and Assurant Inc.

The purpose of this questionnaire is to allow RSL to identify a number of suitably qualified and experienced suppliers. Homogeneous The basis of insurance is sharing risk between a large homogeneous group with similar exposure to loss Units with the same or similar exposure to loss are referred to as. Annually renewable term policies provide a level death benefit for a premium that Increases annually.

The insurer credits the cash value in the policy with a current interest rate. An agent offers his client free tickets to a sporting event in exchange for the purchase of an insurance policy. PGR and CNA Financial Corp.

Recommend financial products such as stocks bonds mutual funds or insurance. Maintains the central records reflecting the financial status of the state taken as a whole at the level deemed necessary for central financial management. Variable production costs for the expected sales under present production methods are estimated at10200000 and fixed production operating costs at present are 1560000.

Immc Swd 282021 29152 Eng Xhtml Part 2021 335571v1 Docx

European Flag European Commission Brussels 22 9 2021 Swd 2021 260 Final Commission Staff Working Document Impact Assessment Report Accompanying The Documents Proposal For A Directive Of The European Parliament And Of

Chapter Iii Risk Transfer And The Insurance Industry In Risk Transfer And The Insurance Industry

European Flag European Commission Brussels 22 9 2021 Swd 2021 260 Final Commission Staff Working Document Impact Assessment Report Accompanying The Documents Proposal For A Directive Of The European Parliament And Of

European Flag European Commission Brussels 22 9 2021 Swd 2021 260 Final Commission Staff Working Document Impact Assessment Report Accompanying The Documents Proposal For A Directive Of The European Parliament And Of

European Flag European Commission Brussels 22 9 2021 Swd 2021 260 Final Commission Staff Working Document Impact Assessment Report Accompanying The Documents Proposal For A Directive Of The European Parliament And Of

Pdf The Effect Of Risk Management On Financial Performance Of Insurance Companies In Ethiopia Financial Operational And Enterprise Management Risk Dimensions

General Insurance Flashcards Quizlet

European Flag European Commission Brussels 22 9 2021 Swd 2021 260 Final Commission Staff Working Document Impact Assessment Report Accompanying The Documents Proposal For A Directive Of The European Parliament And Of

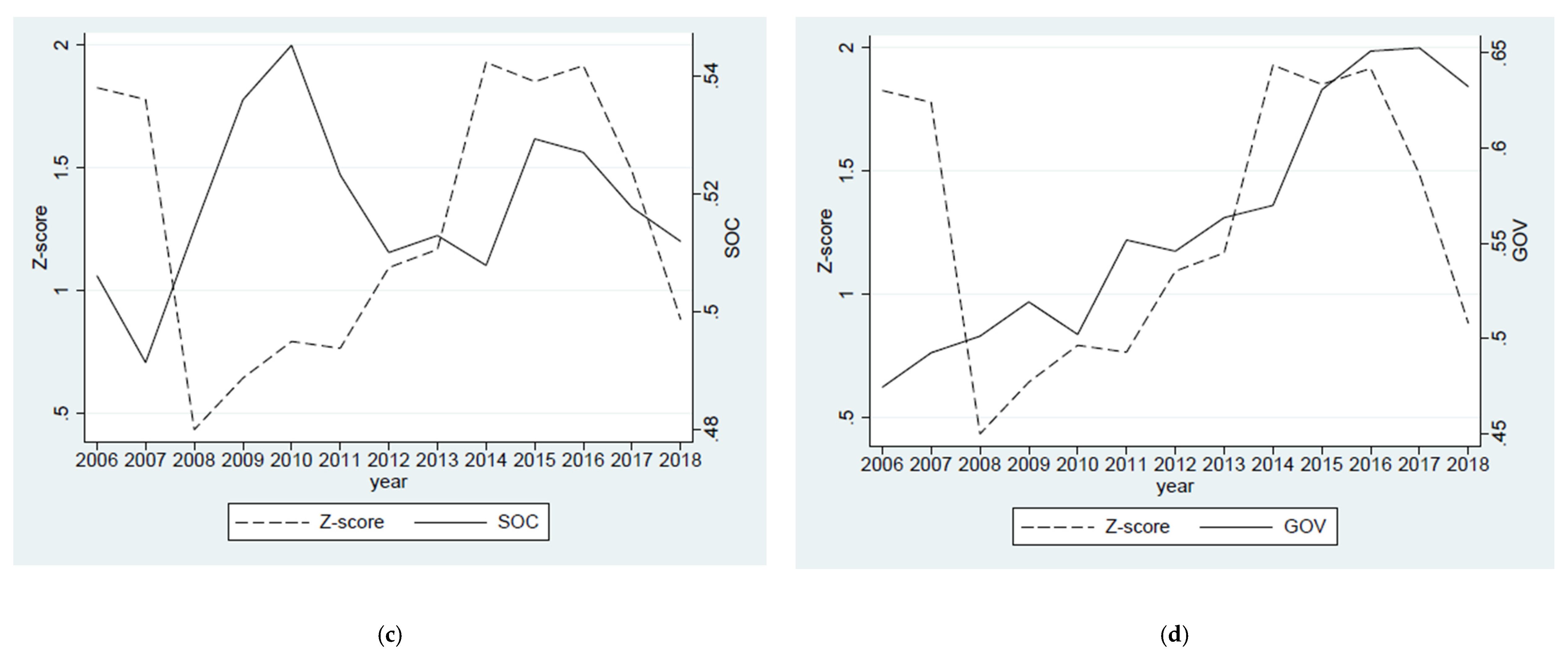

Sustainability Free Full Text Sustainability Practices And Stability In The Insurance Industry Html

European Flag European Commission Brussels 22 9 2021 Swd 2021 260 Final Commission Staff Working Document Impact Assessment Report Accompanying The Documents Proposal For A Directive Of The European Parliament And Of

Bancassurance And The Coexistence Of Multiple Insurance Distribution Channels Emerald Insight